Outrageous Info About How To Check For Multicollinearity

A simple method to detect multicollinearity in a model is by using something called the variance inflation factor or the vif.

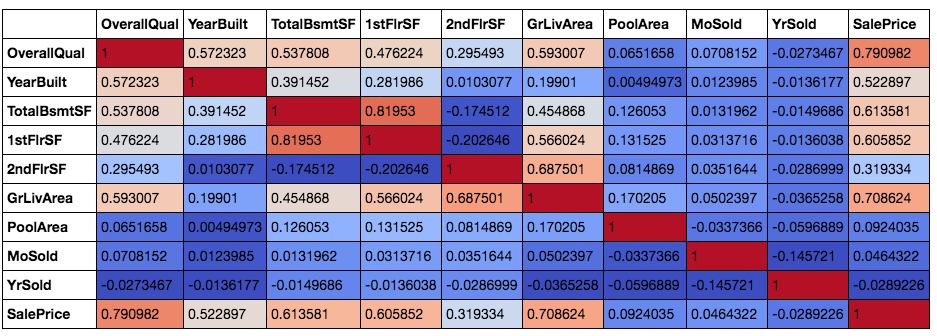

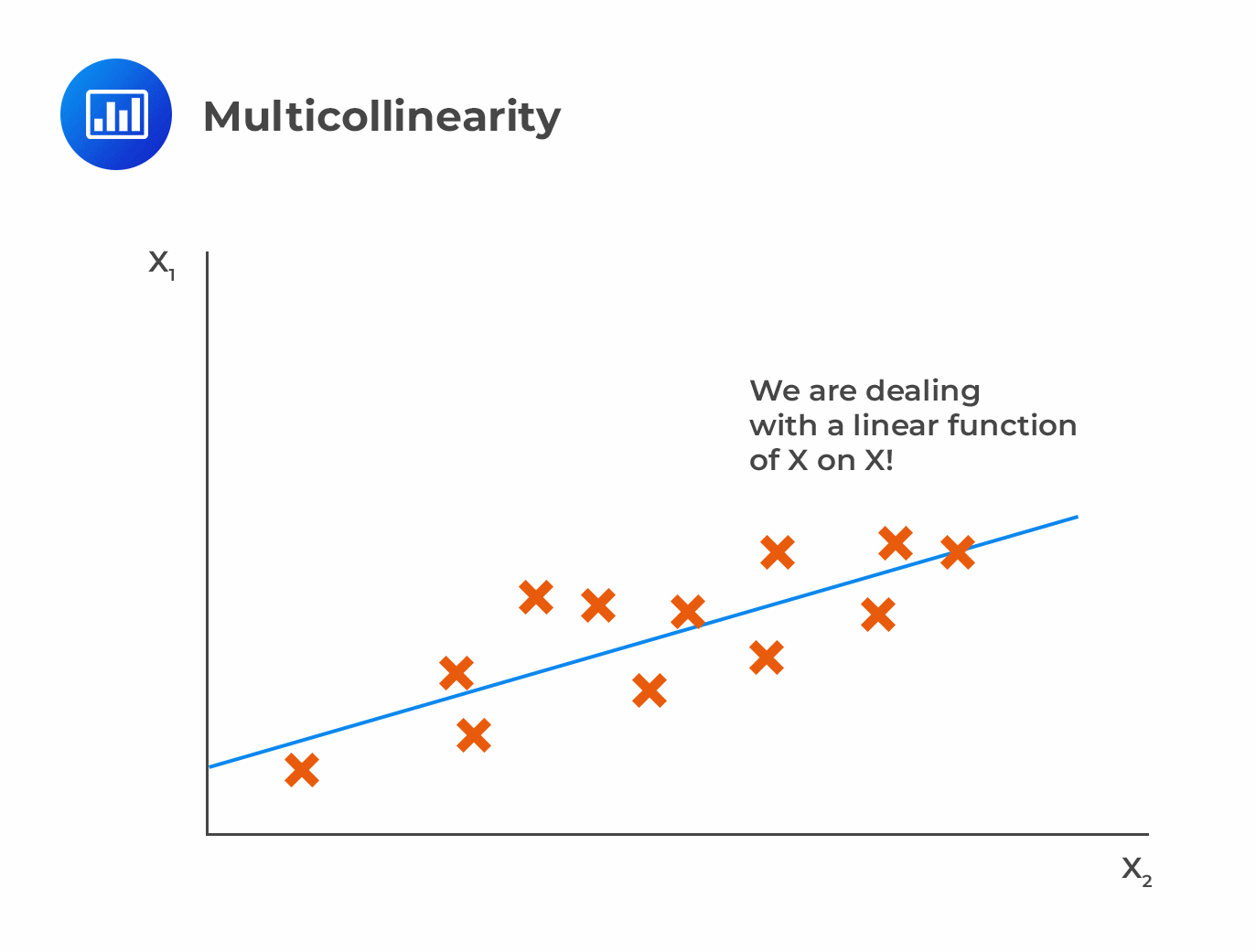

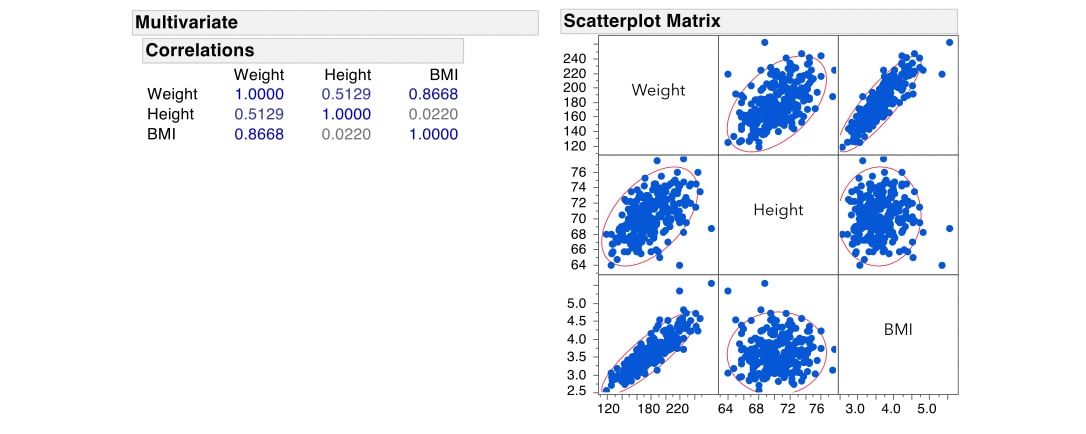

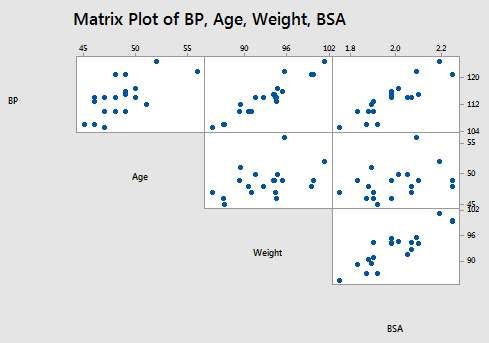

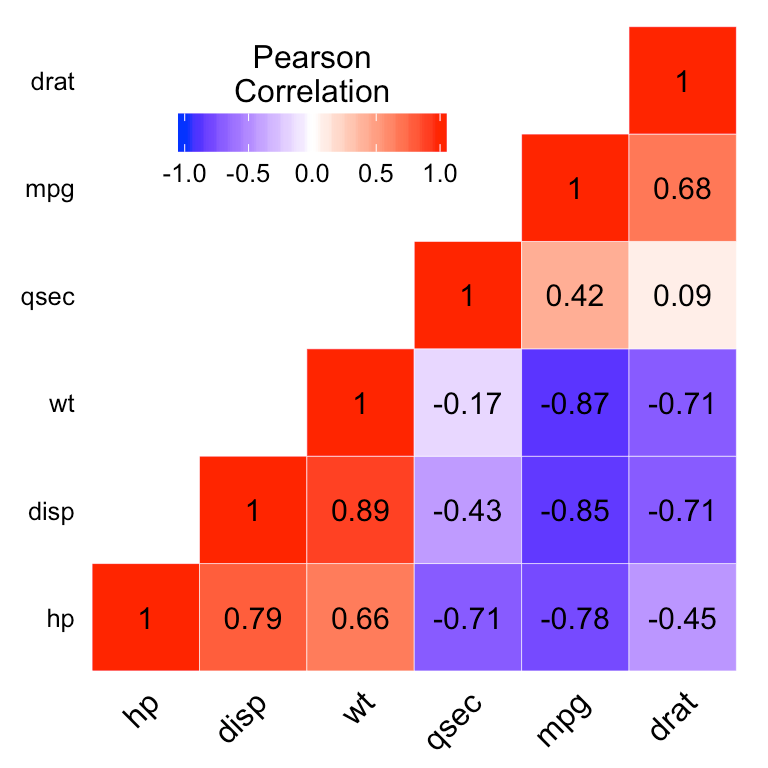

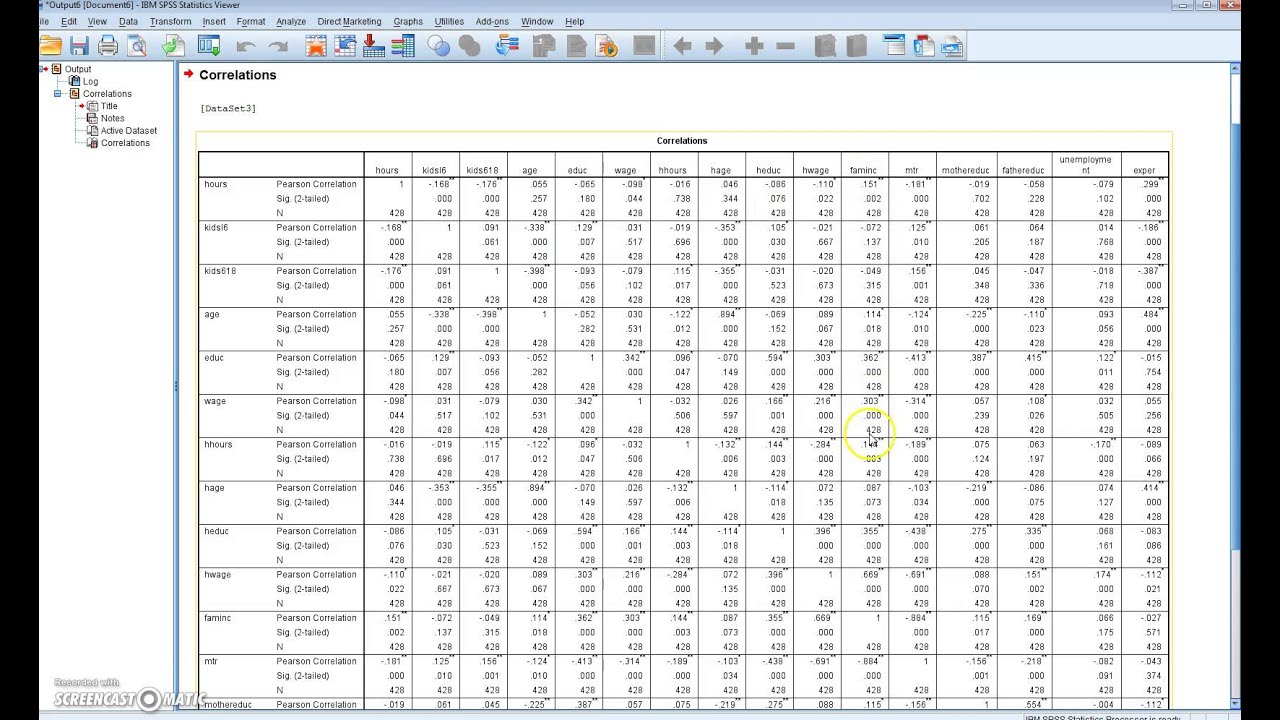

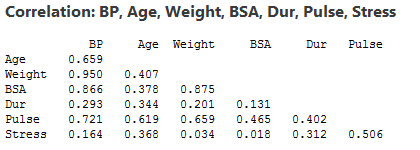

How to check for multicollinearity. One popular detection method is based on the bivariate correlation between two predictor. It is a measure of multicollinearity in the set of. If x1 = total loan amount, x2 = principal amount, x3 = interest amount.

Variance inflation factor (vif) is used for detecting the multicollinearity in a model, which measures the correlation and strength of correlation between the independent. In the multicollinearity test, i will test whether there is a strong correlation between advertising costs and marketing personnel. Variance inflating factor (vif) is used to test the presence of multicollinearity in a regression model.

This video explains how to use microsoft excel to calculate the correlation coefficients and interprets the results. The most common way to detect multicollinearity is by using the variance inflation factor (vif), which measures the correlation and strength of. It is defined as, for a regression model.

The best way to identify the multicollinearity is to calculate the variance inflation factor (vif) corresponding to every independent variable in the dataset. Variance inflation factors (vif) measures. Vif(variance inflation factor) is a hallmark of the life of multicollinearity, and statsmodel presents a characteristic to calculate the vif for each experimental variable and.

How to detect and eliminate multicollinearity. Well, it’s time for us to do a. We can find out the value of x1 by (x2 +.

But it’s not always easy to tell that the wonkiness in your model comes from multicollinearity. A measure that is commonly available in software to help diagnose multicollinearity is the variance inflation factor (vif).