Unbelievable Info About How To Buy Another Home

Here are the two most popular options for buyers:

How to buy another home. But if you don’t have a down payment in the bank, it doesn’t mean you can’t buy a second home. Given all the steps and paperwork involved in selling and buying a home at the same time, you’ll want. This means that your offer on a new home is.

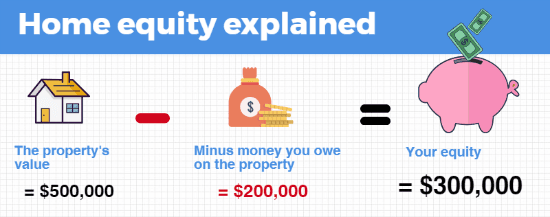

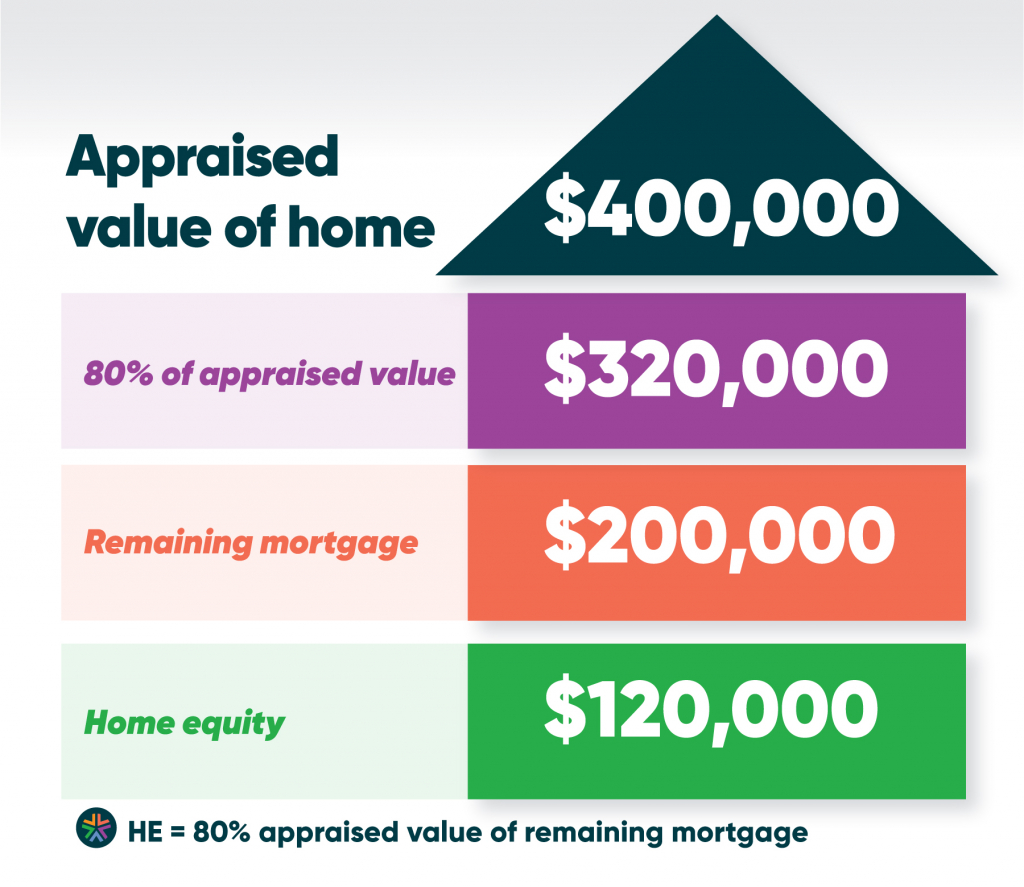

If you have enough equity in your home, you can use the money from a home equity loan to buy another house. This type of loan is not backed by the federal government. If you need to sell one property and buy another, how can you de.

Making repairs, painting, completing small upgrades, and staging with tasteful decor and furniture can help you sell faster. According to the real estate staging association, unstaged homes. First, you can always use savings to purchase a second home.

To qualify for a loan on a second home, you’ll need a down payment of at least 10% on a conventional loan. Buyers can request that their new home purchase be dependent on the successful sale of their old. If you need to sell one property and buy.

Remortgage to buy second home, remortgage buy to let deals, remortgage to buy another property, remortgage buy to let property, how to remortgage your home, remortgage buy to let. A home equity loan can provide enough cash for you to make a larger down payment on the new property, which may help you. If you already own a house, you understand that the costs of home ownership go.

Like regular mortgages, home equity loans are secured by. Buying a new home is exciting, but combining that process with a home sale can be stressful. Another option is a cash.